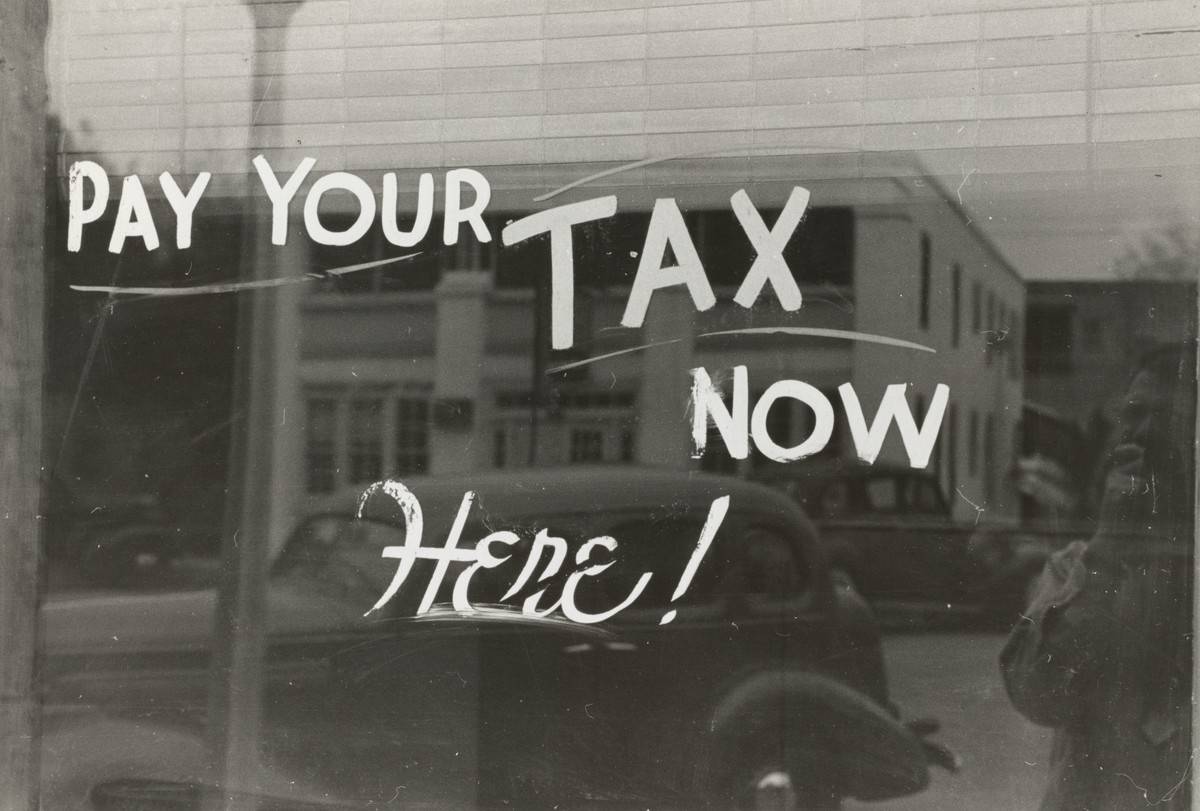

IRS back taxes Microsoft over offshore money flows

Microsoft is currently embroiled in a financial controversy with the Internal Revenue Service (IRS) that has left many stunned. According to an SEC filing, the IRS has notified Microsoft that it owes a staggering $28.9 billion in back taxes, accompanied by penalties and interest, for the years spanning 2004 through 2013.

The IRS back taxes Microsoft filing is a reminder of the complexities surrounding corporate taxation and the fine line between legitimate tax optimization and legal challenges. As this high-stakes battle unfolds, the outcome will undoubtedly set a precedent for how multinational corporations navigate tax regulations and how governments ensure tax compliance.

Why IRS back taxes Microsoft?

The IRS back taxes Microsoft for allegedly transferring profits to offshore tax havens in order to reduce its tax liability in the United States. The IRS claimed that Microsoft's transfer pricing arrangements were unfair and allowed the company to avoid paying billions of dollars in taxes.

Microsoft has denied the allegations and has appealed the IRS's decision. The case is still ongoing, and it is unclear how it will be resolved.

Transfer pricing is a complex issue, and there is often a lot of disagreement about how to allocate profits between different countries. The IRS has become increasingly aggressive in challenging the transfer pricing arrangements of multinational corporations, and Microsoft is not the only company that has been back taxed for this reason.

Some people believe that Microsoft is being unfairly targeted by the IRS, while others believe that the company should pay its fair share of taxes. The outcome of the case could have a significant impact on other multinational corporations and on the way that transfer pricing is regulated.

Read also: Worldwide PC Shipments declined by 9% in Q3 2023.

VP responses to IRS back taxes Microsoft filing

In response to the IRS back taxes Microsoft filing, Microsoft's corporate VP for worldwide tax and customs, Daniel Goff, took to a blog post to address the matter. Goff emphasized that Microsoft has made substantial changes to its corporate structure and practices since the years covered by the audit.

He highlighted that the issues raised by the IRS are pertinent to the past but not reflective of Microsoft's current practices. Furthermore, Goff noted that the IRS's proposed adjustments do not account for the amounts Microsoft paid under the Tax Cuts and Jobs Act, which could potentially reduce the final tax owed by up to $10 billion.

Advertisement