Manage your money in Linux with HomeBank

For many Linux users one area where Linux needs some improvement is money management. Yes there is the very powerful GnuCash (check out GnuCash in my article "GnuCash: Open source Accounting/Financing goodness"). But many users find GnuCash to be too much power for what they need. There is also the slick KMyMoney, but that depends upon KDE. So what do the non-power, non-KDE users have? One option is HomeBank. HomeBank is a free, open source personal accounting software - with the focus on PERSONAL. So with HomeBank you don't have to worry so much about the complexities of dealing with a double-entry accounting package. Instead, you will find a pleasant, easy-to-use piece of software that will server as a painless interface between you and your checking/savings accounts.

In this article I will show you how to install HomeBank, set up accounts, and use the software.

Features

- Import from CSV, QIF, and OFX (although the import filter is VERY finicky).

- Payee and categories support.

- Autocompletion.

- Tag feature

- Pre-defined transaction.

- Pre-filling transactions from bookmark.

- Multiple transaction edit.

- Transfer between accounts.

- Visual paymode.

- Dynamic minor currency toggle.

- Multi-account.

- Annual budget.

- 57 languages

- Works on GNU/Linux, FreeBSD, Microsoft Windows, MacOSX, Nokia N*** and Amiga.

Installation

Installing HomeBank is simple. Since you will find HomeBank in your distributions' standard repositories you can simply follow these steps:

- Open up your Add/Remove Software tool.

- Search for "homebank" (no quotes).

- Mark the results for installation.

- Click Apply to install.

That's it! You should now find the HomeBank menu entry in the Applications > Office menu (or just under Office if you are in KDE).

First run

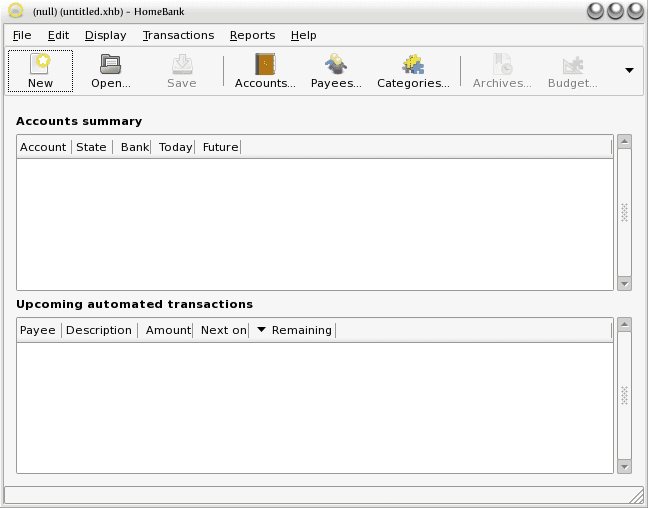

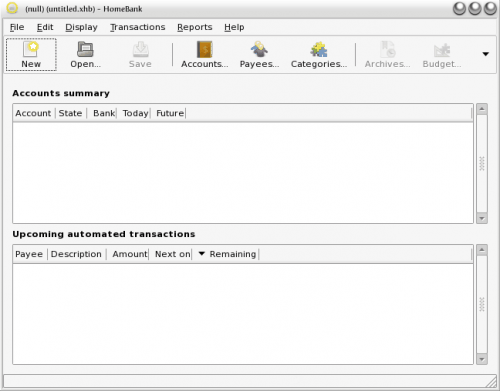

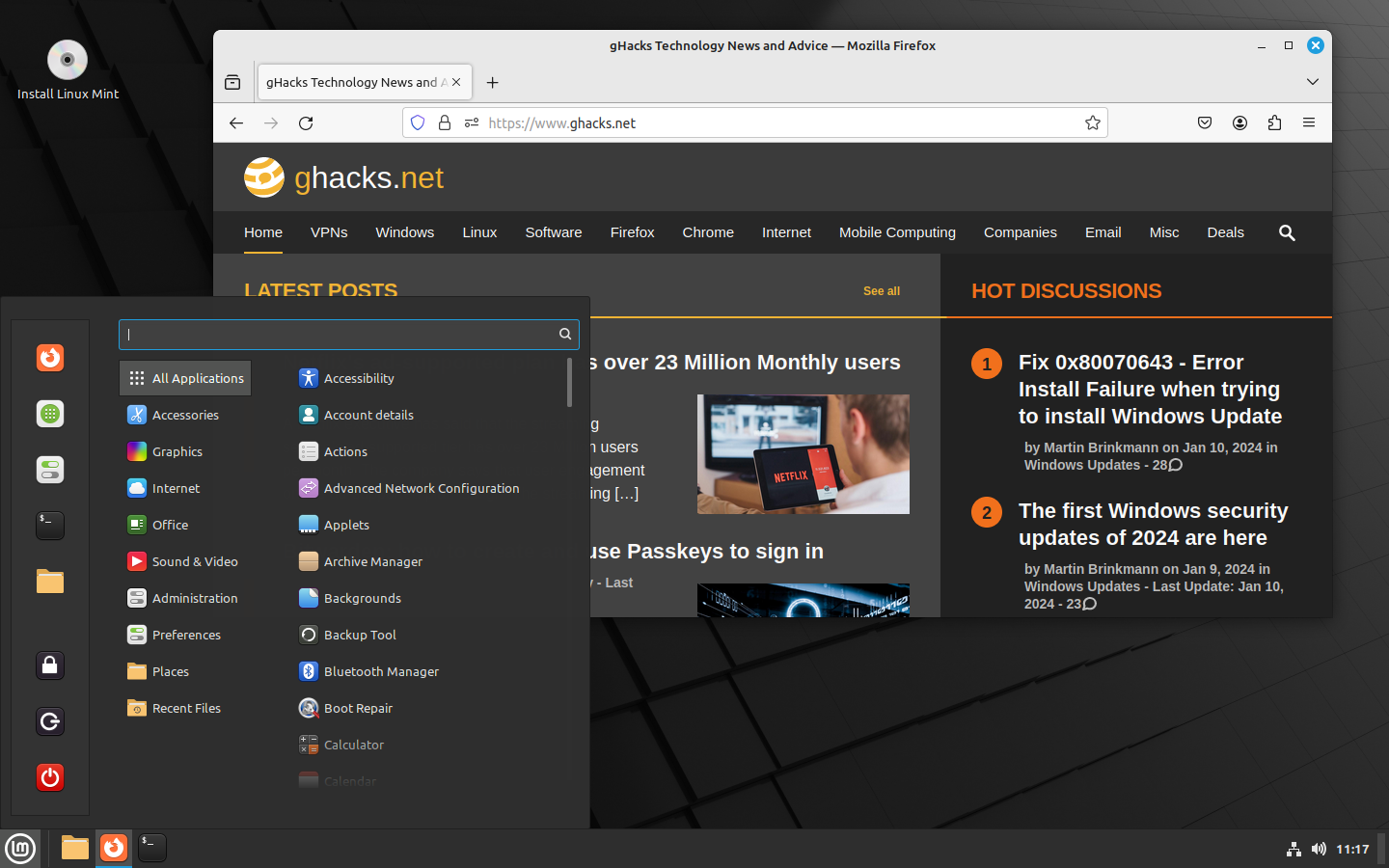

When you first open up HomeBank you would think a "first run" wizard would start. That is not the case. Instead you will be greeted with a home screen containing no accounts (see Figure 1).

The first task will be to create accounts. To do this, follow these simple steps:

- Click the Accounts icon.

- In the new window, click Add.

- Fill out all necessary information for your account.

- Click OK.

Your new account will now show up in the main window.

There are two ways to approach using HomeBank. You can use it haphazardly or you can plan out your use so that the yearly budget feature works for you. In order to plan out HomeBank, you will want to first create Payees and Categories. Each transaction can have a Payee and a Category assigned. Here's how they work:

- Payee: Is who the transaction actually goes to (a retail store, restaurant, utility, etc).

- Category: Is what the transaction is related to. These can be debits or credits (such as Income or expenses).

If you set these up first, you will have a much better time tracking your expenses. Naturally you won't be able to fill in all payees at first. You can add payees as you go. Creating both Categories and Payees is simple:

- Click the appropriate button.

- Enter a name for either the Payee or Category.

- In case of Category check the "Income" check box if it is an income category.

- Click the Add button to add the new item.

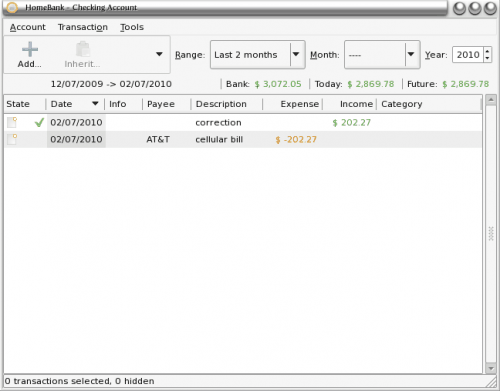

When you are back at the home window, and you have your accounts listed, you can double click on the account you want to use for a transaction. When you do this the account register will open. In that register (see Figure 2) you can see how simple the interface is.

From this interface you can add a new entry (by clicking the Add button), you can filter the entries in the registry, you can inherit a transaction, you can validate/invalidate a transaction, and you can see a running total of the account.

Reports

The reports feature is a nice way to get a graphical representation of your account(s). From this you can see detailed charts of your accounts. The reports you can view are:

- Statistics

- Overdrawn

- Budget

- Car costs

Final thoughts

If you are looking for an accounting software that is targeted more for users and not accountants or businesses, HomeBank is the software for you. Not only can you keep a running record of your expenses, but you can see your yearly budget at a glance to see your personal spending trends.

Advertisement

I can confirm above comments re MoneyManagerEx, as I’ve been using it for several years. It is cross platform also-running in Linux and Windows.

It looks like Homebank can now split transactoins.

I just tried setting up HomeBank after trying to use GnuCash (waaay overkill; I am not a stock market day trader nor do I run my own small business). So I set up a checking account and entered in data from one of my bank statements: the starting balance, eleven checks, one ATM withdrawal, and two wage deposits. And the result is: the final balance provided by HomeBank doesn’t match my bank statement! Not. even. close. It is different than the starting balance; it just has no connection with the data input nor reality.

So it is simpler than GnuCash; it just can’t subtract or add. And there is no explicit Income category, just Payees. But to quote the (online) help: “The payee identify people you give money to, as like as those you receive money from.” So there’s that. What ever ‘that’ means.

Plus, there is no register-style interface to show the change of your account blance with each line entry; just the entries and a sum total in the upper right corner of the page (which in my case was the incorrect amount). The entry stuff is probably my fault, but not having a register style interface is really mind boggling and a deal breaker; what do French cheque books look like?

I had hopes for HomeBank, but I’ll have to keep looking. I really didn’t think it was going to be this hard to find a simple personal finance package for Linux.

Read my comment on Money Manager Ex. It’s a far better program than HomeBank. I’ve been using it for about six months with no problems. As I commented earlier, HomeBank cannot split a transaction. You might get it to balance your checkbook but it’s useless for budgeting.

LOL! I just downloaded and started using mmex 0.9.4.2 in Ubuntu! I have run into a slight existing bug: when using the MM/DD/YYYY date format when there is more than one page of transactions, the day and months get flipped when the transaction is saved. I filed a (forth) comment on the open bug report on SourceForge, but this still appears to be the exact program I’ve been looking for.

i enjoy using hibiscus under windows…. but since it is java-based, it should run equally well under linux

I love Linux but I dont think Linux is the best for homebank.

cool. never heard about this app before. i really like MoneyDance, given it is not freeware (still cross-platform tho), but this one looks similar. i wonder what options are lacking that i’d need. will def check it out…

‘But that depends on KDE’ misleads your readers. It reinforces the perception that applications built on the KDE platform are not useful outside the Plasma desktop. KMyMoney is widely used on other desktops and GnuCash and HomeBank used on the Plasma desktop.

It’s been about six months but the last time I tried HomeBank it could not split a transaction. So if you shopped at a department store and purchased items in different categories, there was no way to separate them. This inability renders HomeBank useless for budgeting. A much better alternative is Money Manager Ex. Money Manager does allow transaction splitting and is a far better tool.