Goldman Sachs-Apple partnership might end soon

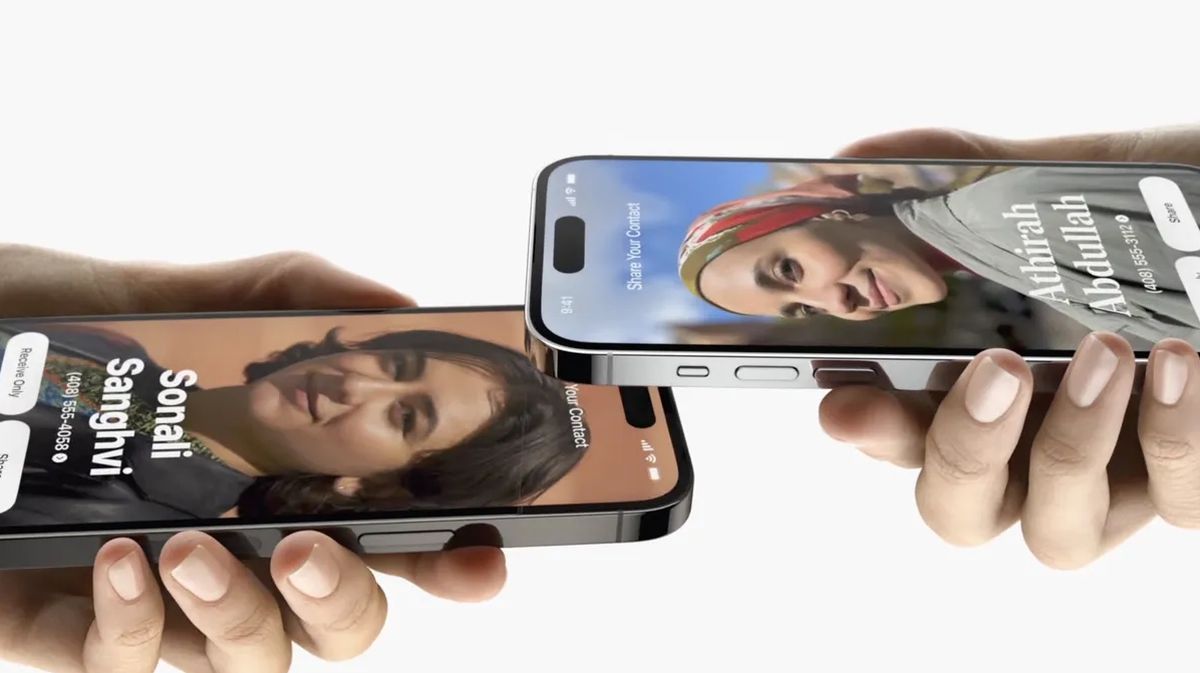

We could see the Goldman Sachs-Apple partnership come to an end soon as the bank does not want to keep working with the technology giant. The companies had agreed on a deal on the American Apple Card credit card, Apple Pay Later, and the Apple Savings account that Apple Card customers can choose from, but it may not last long.

In August 2019, Apple Card was initially introduced to the public in the United States. You could apply for an Apple "Credit" Card and manage your credit purchases, and Sachs would handle them using the Wallet app. However, things did not go as planned for the bank.

Now that the bank is not making but actually losing money, it wants to end the partnership. American Express is in discussions with Sachs, according to the Wall Street Journal, to take over its portion of the deal with Apple, which may be unveiled in the coming months. The WSJ report says that the deal is not "imminent or assured."

Goldman Sachs-Apple partnership cost: $1 billion

Apple has hailed the card as a success, but Sachs, the company behind Apple Card, is reportedly the target of an investigation into its credit card operation. In 2022, Sachs disclosed that since the introduction of the Apple Card, it had lost $1 billion.

Related: Cook is happy with Apple Card Savings' launch

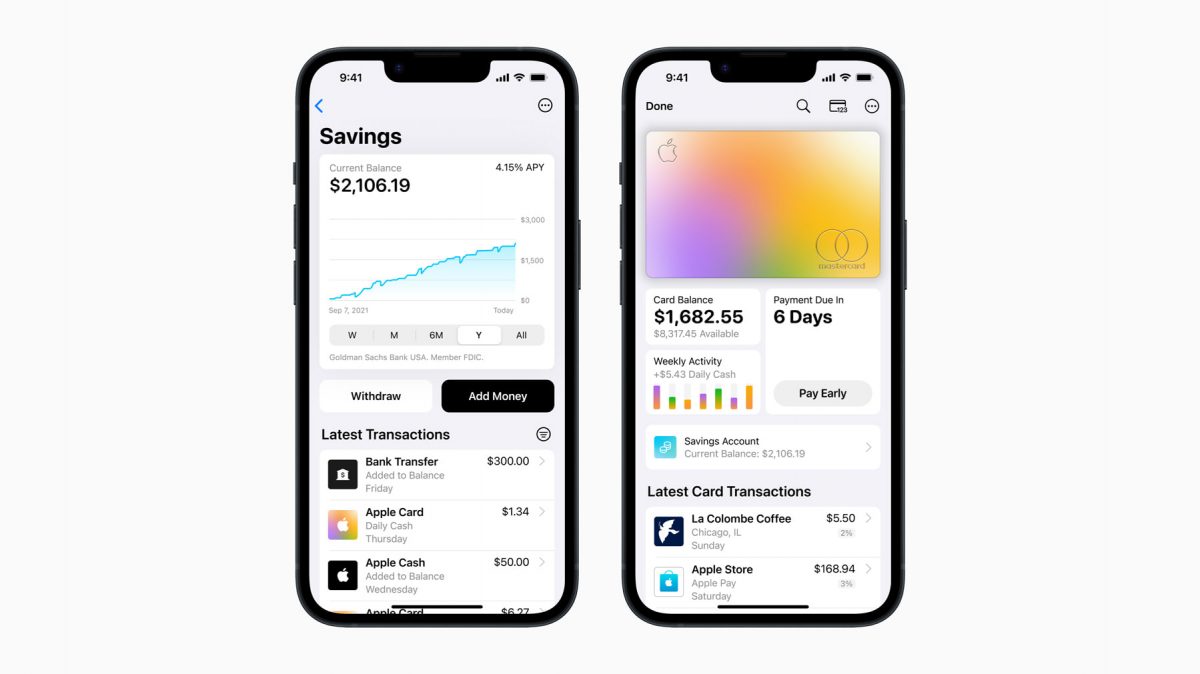

Despite all the struggles and issues the bank had due to its deal with Apple, it still didn't take a step back. Goldman Sachs strengthened its partnership with Apple by introducing the Apple Card Savings Account in April. The Mastercard payment credential required to perform Apple Pay Later transactions is also issued by Goldman Sachs.

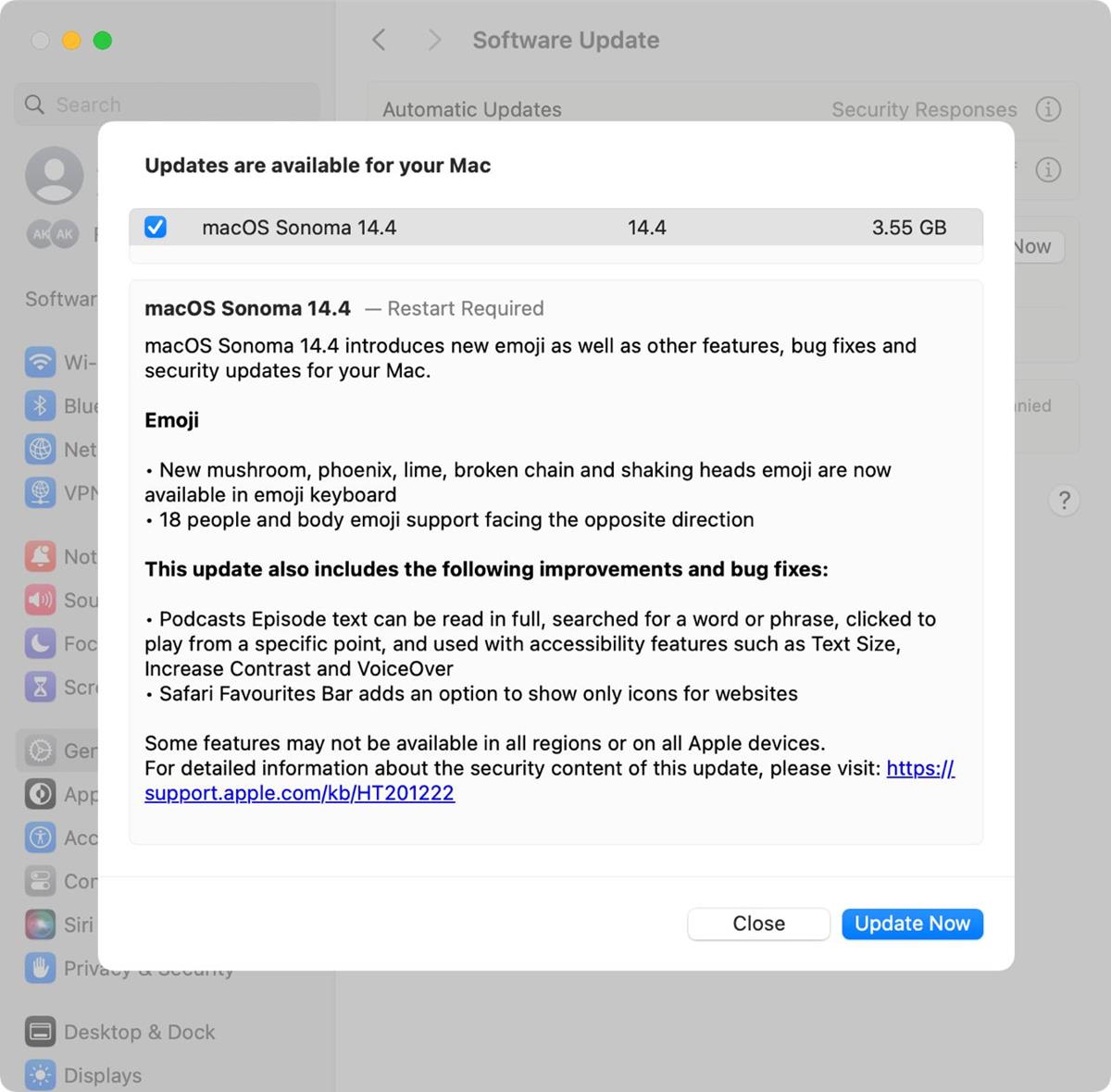

The new Goldman Sachs Savings account allows Apple Card customers to deposit money and earn Daily Cash rewards with a 4.15 percent APY. The rate is more than ten times higher than the national average, claims Apple.

Related: Apple Savings accounts almost reached $1 Billion in four days

Users of Apple Cards can open and maintain their Savings accounts with ease and without any fees, minimum contributions, or balance requirements. Your Daily Cash awards will be deposited into your new account once it is created. A user's ability to generate Daily Cash is unrestricted, and you are always free to choose where it goes.

The banking institution is currently in negotiations with American Express (or Amex) about a potential purchase because it wants to reduce its consumer division. The Apple Card and other credit cards, such as the one it provides for General Motors, would be transferred to another company as part of a transaction that would see Goldman Sachs shift its credit card agreements to that firm.

Advertisement