The Fall of Tech's Finest: Earnings Reports Show Major Setbacks

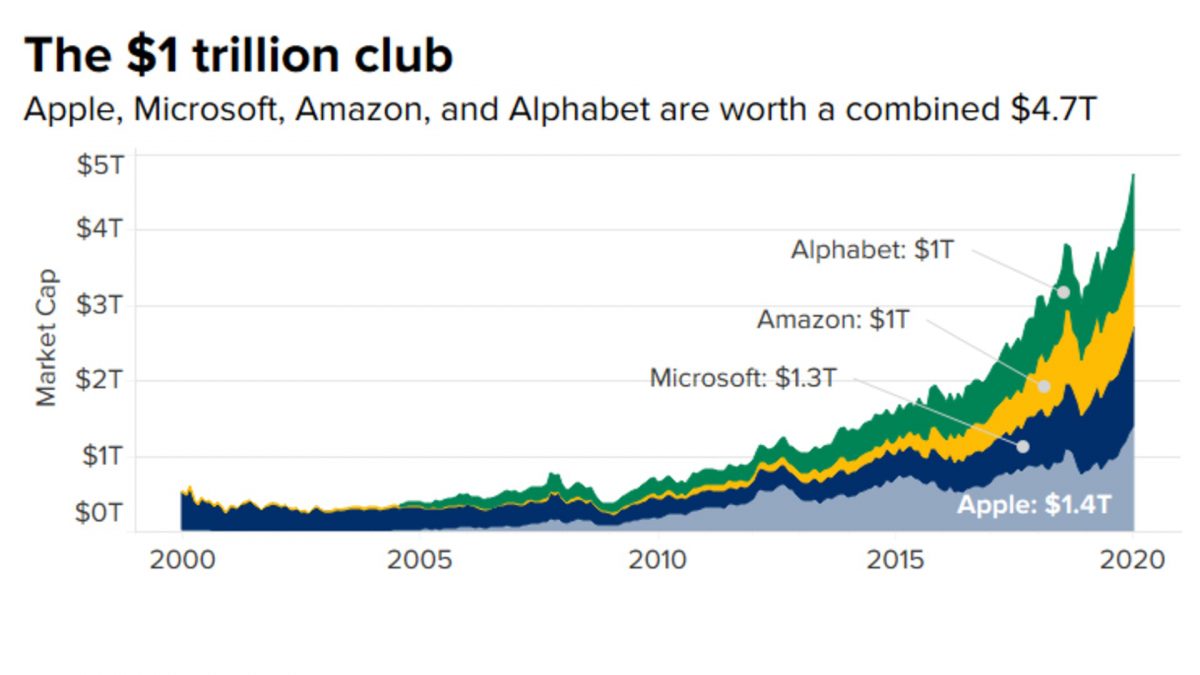

On Thursday, the three big tech giants - Apple, Amazon and Alphabet, collectively referred to as the A-Team, all posted unsatisfactory results, contrast to the previous day's positive outcome from Facebook, which delivered results that exceeded expectations. Apple's stock dropped over 4% after releasing its Q1 earnings, which fell short of projections for revenue, profit, and sales.

The iPhone manufacturer, Apple, failed to meet analyst predictions for profit for the first time in seven years due to disruptions in iPhone production caused by the strict Covid-19 lockdowns and related demonstrations in China, its largest supplier. Apple also reported its largest quarterly decline in revenue in nearly seven years, registering $117.2 billion, a decrease of 5.49% from the previous year when it recorded record holiday sales. This amount was lower than the average estimate of $121.10 billion made by analysts.

Related: Google is rumored to be developing AirTag-like location tracking devices to rival Apple

In the press release accompanying its earnings report, Apple acknowledged ongoing challenges. The strict lockdowns in China, where 90% of its globally sold devices are produced, resulted in approximately $4 billion in lost sales in 2022, which has been deemed as shocking by observers. During the Thursday investor call, Cook stated that the iPhone revenue would have increased in the quarter if not for these supply disruptions, but production has returned to pre-shutdown levels.

For many years, Apple was considered a stable investment option in the tumultuous tech industry, but analysts believe this latest report signals a shift. In its October earnings call, the company had already signaled a potential slowdown, with the CFO, Luca Maestri, attributing it to the ‘continued uncertainty around the world.’

‘Apple’s poor quarter proves that even the most valuable US-traded company isn’t immune to the challenges facing the tech industry at large.’ This from a senior analyst at Investing.com, Jesse Cohen, who added that the report was ‘shockingly weak.’

On Thursday, Amazon posted earnings that fell below expectations, while at Alphabet, a decline in advertiser spending impacted the search company's revenue. The tech and retail giant is currently facing a difficult adjustment following its pandemic-driven growth and recently announced plans to cut 18,000 jobs. It reported a net loss of $2.7 billion for 2022, compared to a net income of $33.4 billion in the previous year. This loss included a pre-tax loss of $12.7 billion on its investment in electric vehicle maker Rivian. Despite this, net sales rose 9% to $514 billion, compared to $469.8 billion in 2021.

Back at Amazon, its most reliable asset, Amazon Web Services, reported sales of $21.4 billion, a 20% increase from the previous year but below the expectations of analysts. Alphabet also fell short of analyst projections, indicating a drop in demand for its search advertising during an economic slowdown. The company's sales for the quarter were $63.1 billion, slightly lower than the expected $63.2 billion.

In the previous month, Alphabet reduced its global workforce by 6%, or 12,000 jobs, with the goal of becoming a more streamlined and efficient company. However, it was subsequently faced with a lawsuit from the US Department of Justice, alleging that the company engaged in abusive practices in its dominance of the digital advertising market. These earnings results stand in contrast to the positive performance at Meta, the parent company of Facebook.

However, it’s not all doom and gloom in tech sphere. On Thursday, Meta's stock saw a surge of up to 26%, its largest one-day increase in almost a decade.

The significant increase in Meta's share price followed CEO Mark Zuckerberg's commitment to streamline the social media company, which was well-received by analysts, many of whom upgraded their recommendations on the stock. Apple, unlike its tech peers, has not yet undergone widespread layoffs. During Thursday's investor call, Cook did not mention layoffs, but stated that the company would be cautious in monitoring its labor expenses. He said, ‘We’re cutting costs, we’re cutting hiring, we’re being very prudent and deliberate on people that we hire.’

Those laid off at these big Tech companies right now are mostly in sales, human resources and other non-related ‘tech’ positions. The tech engineers, programmers and developers who get laid off have the option of going to a non-tech company where their skills would be highly valued, e.g. finance and health care could do with some technological changes. They might find the move a refreshing change, however if salary/benefits is the main driver, another burnout pit awaits them.

Bullish.

Market anomalies do impact earnings. CEOs need to share the pain.

The knee jerk reaction is to layoff thousands of employees.

Tim Cook is taking a large pay cut in 2023 (the Board forced it). The others need to do the same. ‘When more is not enough’ has to stop.

The combined gain from salaries and benefits of 1000 fired employees would not equal one third the size of a A-Team CEO bonus package.