Buffett: Apple outshines Berkshire's top holdings

During Berkshire Hathaway's annual meeting today, Warren Buffett, the company's chairman and CEO, expressed his admiration for Apple, stating that it is the best company owned by his conglomerate. Additionally, he remarked that iPhones have become an essential part of people's lives, even more so than a second car.

Since 2016, Berkshire Hathaway, led by Warren Buffett, has demonstrated a strong confidence in Apple by investing in the company's stocks. Despite expressing on multiple occasions, including today, that he lacks an understanding of devices such as the iPhone, Buffett does comprehend consumer behavior and recognizes the deep-seated loyalty that customers have towards Apple.

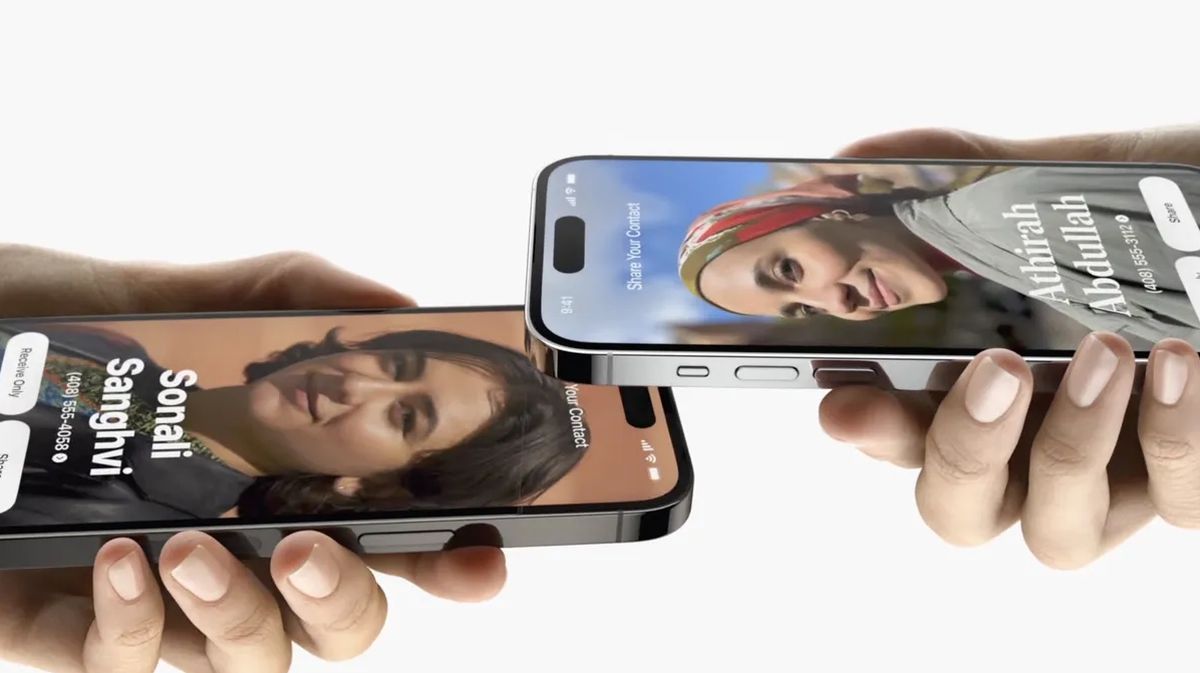

In an interview last month, Buffett attempted to illustrate the extent of this loyalty by stating that he believes Apple users would not relinquish their iPhones even for a substantial sum of $10,000.

During the annual Berkshire Hathaway meeting held over the weekend, Buffett reiterated his belief in the remarkable loyalty that Apple enjoys among its customers, highlighting the fact that for many iPhone users, the device has become more important than owning a second car, reports Yahoo Finance. This further reinforces his conviction in the unwavering support that Apple receives from its loyal consumer base.

Users would give up their car before their iPhone

“Apple is in a position with consumers, where they’re paying maybe $1,500 bucks, or whatever it may be, for a phone. And the same people pay $35,000 for having a second car, and [when] they have to give up a second car or give up their iPhone, they’d give up their second car. I mean, it’s an extraordinary product. We don’t have anything like that that we own 100% of, but we’re very, very, very happy to have 5.6%, or whatever it may be, and we’re delighted every 10th of a percent that goes up,” Buffett stated.

Over the years, Buffett's belief in the strength of Apple has continued to intensify. In 2020, he declared that the company was "probably the best business in the world." Today, he reaffirmed his stance and emphasized that he no longer considers it to be a mere probability, but rather a certainty. He went on to underscore that Apple is superior to anything that Berkshire fully controls, unequivocally stating that "it is a better business than any we own." This unequivocal endorsement reinforces his strong confidence in the tech giant and its future prospects.

Berkshire Hathaway's confidence in Apple is reflected in the company's impressive financial performance. Currently, the conglomerate owns approximately 5.6% of Apple's shares, which are valued at a staggering $116 billion. Moreover, Apple is the top equity holding in Berkshire's portfolio, accounting for nearly 40% of its total equity investments, which are valued at approximately $300 billion. In addition to Apple, other top equity holdings in Berkshire's portfolio include Bank of America ($33.45 billion), Chevron ($29.25 billion), Coca-Cola ($25.44 billion), and American Express ($22.40 billion).

After Apple's fiscal Q2 earnings report was released, the company's stock (AAPL) experienced a surge in value, primarily due to the impressive sales figures for the iPhone and record-breaking revenue from its Services division. Despite a minor decline in overall revenue, these robust sales figures and revenue streams bolstered investor confidence in the company's future prospects, leading to a bump in AAPL shares.

Advertisement