Gmail integrated Google Wallet lets you send money right away to scammers

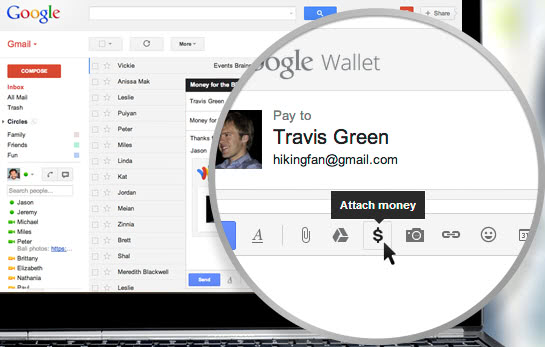

Email attachments have been limited to files for as long as they have existed. This changes soon with Google's announcement that it will integrate the company's own Google Wallet payment service right into Gmail. The idea here is to attach money using Google Wallet to an email to make payments right away from the interface.

Update: The option to send and receive money with Gmail is still available. It is now available to users from the US and UK, and requires Google Pay, Google's current payment system.

Why would Google introduce something like that to Gmail? To push Google Wallet to a larger audience of course. That's the same strategy that worked when it started to plaster all of its properties with Google Chrome ads and Google+ links.

What about the user? While it is certainly comfortable to send money from within an email, it is not such a big step forward as many seem to think it is.

First of all, it is necessary that both parties have a Google Wallet account. The recipient does not need to have one right away, but to claim the money, an account is needed.

Then, adding a send money option to an email program can certainly be problematic. Think of all those phishing and scam emails that ask you for a small payment so that you can receive millions or even billions in return. We all know that those are scam, but there still seem to be some that never heard of Nigerian scams before, or any other form of scam for that matter. While Nigerians scammers can't use it right now, due to the US-only limitations, it may open the door for scams even further than before.

Gmail and Google Wallet Facts

- The feature will be rolled out to all Gmail users from the United States over the coming months that are 18 years or older.

- The only way to get access to the feature early is when friends send you money using the feature.

- Money that is not claimed after 14 days will be returned to the sender.

- The money will appear automatically in existing Google Wallet balances after you have claimed it.

- You can only send money inside the United States.

- The daily transfer limit is $10,000 and $50,000 per 5 day period. This includes money sent and money transferred in and out of your Google Wallet Balance.

- Sending money from a bank account or your Google Wallet balance is free. If you send money using a credit card, you pay a fee of 2.9% per transaction (minimum $0.30).

- You can transfer money you receive to your bank account, or spend it online. To add a bank account, you do need to verify your Google account.

Verdict

I'm not saying it is all bad as I can see its practical use as well. Say you are planning a weekend trip with a couple of friends. To collect the money, you may use the send money feature which can be useful if you are all using Gmail anyway to communicate with each other. If someone uses another provider, things get complicated quickly though.

If you are using Gmail's web interface, are from the US and have a Google Wallet account, it may open up new possibilities for you, especially if you do not use Google Wallet on your phone.

They got to Yahoo. Is Google less vulnerable?

http://www.securityweek.com/yahoo-japan-suspects-22-million-ids-stolen

Payment facilities integrated into a webmail service does not, by itself, make it more likely that scammers will have an easier time. Anyone stupid enough to fall for those scams will fall for them even if it requires two steps as opposed to one. PayPal makes online movement of money safer because it inserts itself between the payer and payee; i.e., PayPal independently takes steps to verify the identities and coordinates of the parties and provides some protections if either does not perform as agreed. If Google does the same, it will be a good alternative to the increasingly arrogant PayPal.

What concerns me about linking my money with an email service is the potential for the service provider being compromised and my banking information with it. In addition, Google has not always stuck to its “Don’t be evil” mantra; witness the “inadvertent” spying it did with their street-mapping efforts. Still, Google has the means, expertise and online experience to do this as well as anyone.

Finally, the America-only-for-now thing is to be expected: The banking system and laws are mature and carefully monitored; ATMs, bank cards and money-collection points are ubiquitous and Google is a U.S.-based entity. And, here, they currently are not being sued as they are in Europe. We won’t even discuss China and only offer passing mention of India.

Personally, I’ll at least establish an account when it becomes available to me. Having another option never hurts.

Martin,

Please do not misunderstand me and I did not understand it that way. I am certainly not pleased about scammers from Nigeria giving us all a bad name (they are called 419ers in Nigeria because advanced fee fraud is illegal according to section 419 of the Nigerian criminal code). There are quite a few Nigerians who engage in advanced fee fraud for whatever reason and that is a fact. I am so glad that you are not hung up on it.

With regards to the number of steps required for payment, the Google Wallet integration to Gmail makes the number of steps exactly the same as using a PayPal mobile app ( I have used the paypal mobile app) and I would love to see more competition in this area, if only to reduce the dominance of PayPal, MasterCard and Visa. I hope this will result in better payment services for both users and merchants as competition will eventually drive down the cost of these services. I suspect that much of the 2.9% charge for credit cards is certainly going to MasterCard and Visa.

Personally, I have a suspicion that Google is looking to capture future users of the internet with this payment service and I look forward to being able to send money from Europe to Nigeria with the click of a button. Right now, sending money is so complicated and the fees charged by the UK banks and other payment services will make you cry.

while it may have the same steps, I cannot confirm that as I have not used both, it is its integration into Gmail that concerns me the most. If you receive a scam email that asks you to transfer money via PayPal, you still have to go to PayPal to do so. If you get a scam message that says use Google Wallet, you do not.

While this may not prevent someone from transferring money to the scammer, it is now easier to handle as everything is integrated into the email client directly.

As long as Google Wallet is only fully functional in the US though, I can’t see it competing with the three other services you mentioned. Not going to happen until they open it up to a worldwide audience.

Martin,

How is this so different from Paypal, and why the hangup on “so-called” Nigerian Scammers?

This is an existing service with what is essentially a new interface that you haven’t used yet.

In the interest of full disclosure, I am Nigerian.

It is not really that different from PayPal. The only difference I can see is that it is integrated into Gmail, whereas with PayPal, you need to go to their website to make transactions.

I used Nigerian scammers as an example because everyone knows the term. I did not meant to disrespect all Nigerian people and I apologize if you understood it that way. Scammers come from all locations in the world, not just Nigeria.

The reason why I pointed at the scam aspect is that it eliminates one step in the process if we are talking about online transactions. Instead of having to visit PayPal to make the payment, users can now make payments with the click of the button when they reply to the scammer.

Gmail Actions and Interactive Cards

Gmail uses schema.org markup to accelerate user actions and to highlight the most important information users need from an email.

Gmail supports 4 types of actions and 1 interactive card:

RSVP Action for events

Use to declare an event with an RSVP action. Gmail will show an Event card next to the email, including buttons for RSVP-ing attendance in the event.

Review Action for restaurants, movies, products and services

Use to declare a review action. Gmail may show a review button next to the email, which will prompt the user for a numeric review value and / or a user comment

One-click Action for just about anything that can be performed with a single click

One click actions allow users to perform one-click operations directly from gmail without having to visit your website. One Click actions are performed by declaring an HttpActionHandler with your service URL. For more details about it, refer to Handling Action Requests.

Go-to Action for more complex interactions

Go-To Actions take the user to your website where the action can be completed. Unlike One Click Actions, go-to actions can be interacted with multiple times

Flight interactive cards

Use to declare a flight reservation. Gmail may show a Flight card next to the email, including a button for checking into the flight.

https://developers.google.com/gmail/schemas/overview