Buffett's Berkshire bids farewell to TSMC shares

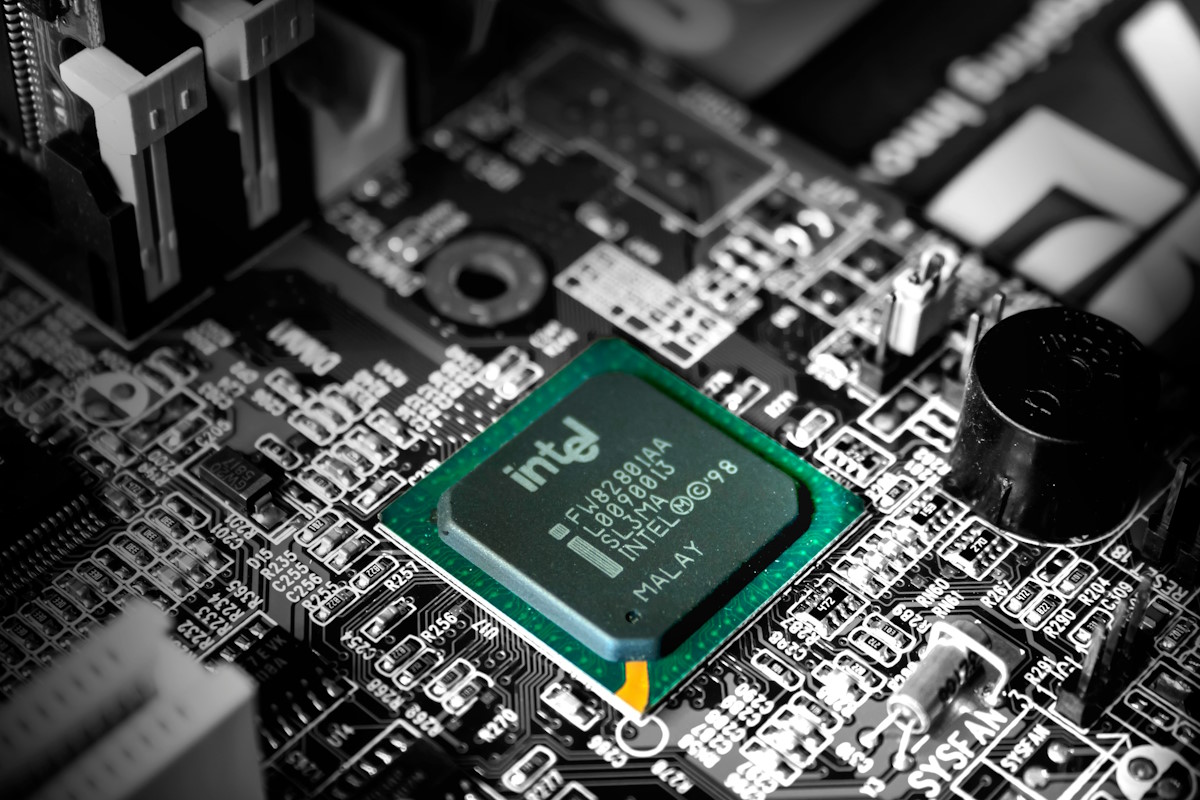

Top investors displayed mixed sentiments towards Taiwan Semiconductor Manufacturing Co. (TSMC) in the first quarter. While Warren Buffett decided to divest his position in the company, hedge funds Tiger Global Management and Coatue Management made fresh investments, signaling differing perspectives on the company's prospects.

Warren Buffett's Berkshire Hathaway Inc. made an exit from Taiwan Semiconductor Manufacturing Co. (TSMC) during the first quarter, as revealed in a regulatory filing, reported Bloomberg. This decision followed a significant reduction of 86% in Berkshire Hathaway's TSMC holdings in the latter part of the previous year. Buffett explained during the annual meeting with investors held earlier this month that the decision was influenced by apprehensions surrounding the geopolitical tensions between China and Taiwan.

Warren Buffett's sudden exit from Taiwan Semiconductor Manufacturing Co. (TSMC) stands in stark contrast to the actions of his counterparts in the investment community. Philippe Laffont's Coatue Management and Chase Coleman's Tiger Global Management, as reported in their recent filings, took a different approach by increasing their holdings of TSMC shares during the first quarter. In fact, TSMC emerged as their most significant new investment during this period, reflecting their confidence in the company's prospects. While Buffett opted to distance himself from TSMC, these prominent investors saw an opportunity to capitalize on the potential of the semiconductor giant.

Following a peak in February, Taiwan Semiconductor Manufacturing Co. (TSMC), the largest contract chipmaker globally, has experienced a loss of momentum. The waning demand for electronic devices on a global scale, coupled with an excess of inventory and geopolitical uncertainties, have dampened investor sentiment. Amid these challenges, investors are eagerly observing for any indications of a potential recovery. TSMC recently affirmed its annual capital spending target, signaling its commitment to consolidating its position in advanced semiconductor technologies.

In response to these developments, TSMC's shares witnessed an early upswing in Taipei on Tuesday, surging as much as 1.7%. This positive momentum came after its American Depositary Receipts (ADRs) closed 2.7% higher in the previous session. The market's response highlights the attention and anticipation surrounding TSMC's performance as investors monitor its progress and seek signs of improvement in the face of prevailing market conditions.

Despite Warren Buffett's decision to divest from Taiwan Semiconductor Manufacturing Co. (TSMC), he has consistently expressed admiration for the company, lauding it as a "fabulous enterprise" and one of the world's best-managed and most significant companies. During a meeting in Omaha, Nebraska, Buffett emphasized that TSMC outshines its peers in the chip industry, acknowledging its exceptional standing. However, he attributed his withdrawal to concerns over TSMC's location, indicating that geopolitical factors influenced his decision.

On a broader scale, policymakers and customers across the globe are becoming increasingly cautious about overreliance on Taiwan, a territory that Beijing claims as part of China. This growing apprehension has prompted TSMC to expand its production capacity in the United States and Japan. The company faces mounting pressure to manufacture its advanced chips overseas to alleviate concerns and reduce reliance on its current location.

Buffett points out Japan instead of Taiwan

Buffett has further expressed a preference for deploying capital in Japan instead of Taiwan, which suggests a strategic shift in his investment focus towards the Japanese market.

“I feel better about the capital that we’ve got deployed in Japan than in Taiwan. I wish it weren’t so, but I think that’s the reality, and I re-evaluated that in the light of certain things that were going on,” stated Buffett earlier this month.

In the upcoming quarter, Taiwan Semiconductor Manufacturing Co. (TSMC) anticipates sales ranging from $15.2 billion to $16 billion. While this falls slightly short of the average projection of $16.1 billion by analysts, it reflects the challenges faced by the company and the wider industry. TSMC, like its counterparts, is contending with uncertainties surrounding the demand for electronics, not only in the current year but also in the foreseeable future.

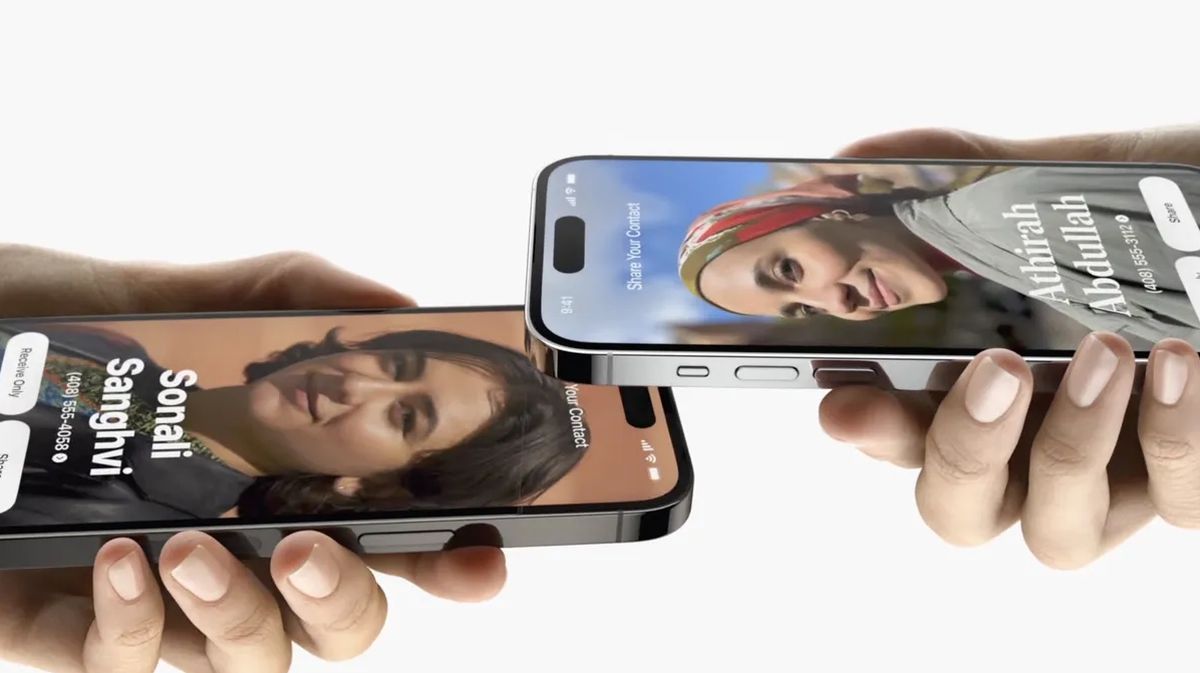

Earlier this month, Warren Buffett reiterated his unwavering belief in Apple's strength and its loyal consumer base during Berkshire Hathaway's annual meeting. He emphasized that for many iPhone users, the device holds more importance than owning a second car. This further solidified his confidence in Apple's future, surpassing any other business Berkshire Hathaway fully controls. With Berkshire Hathaway's substantial investment in Apple, valued at $116 billion, the tech giant remains the conglomerate's top equity holding, comprising nearly 40% of its total equity investments.

Advertisement