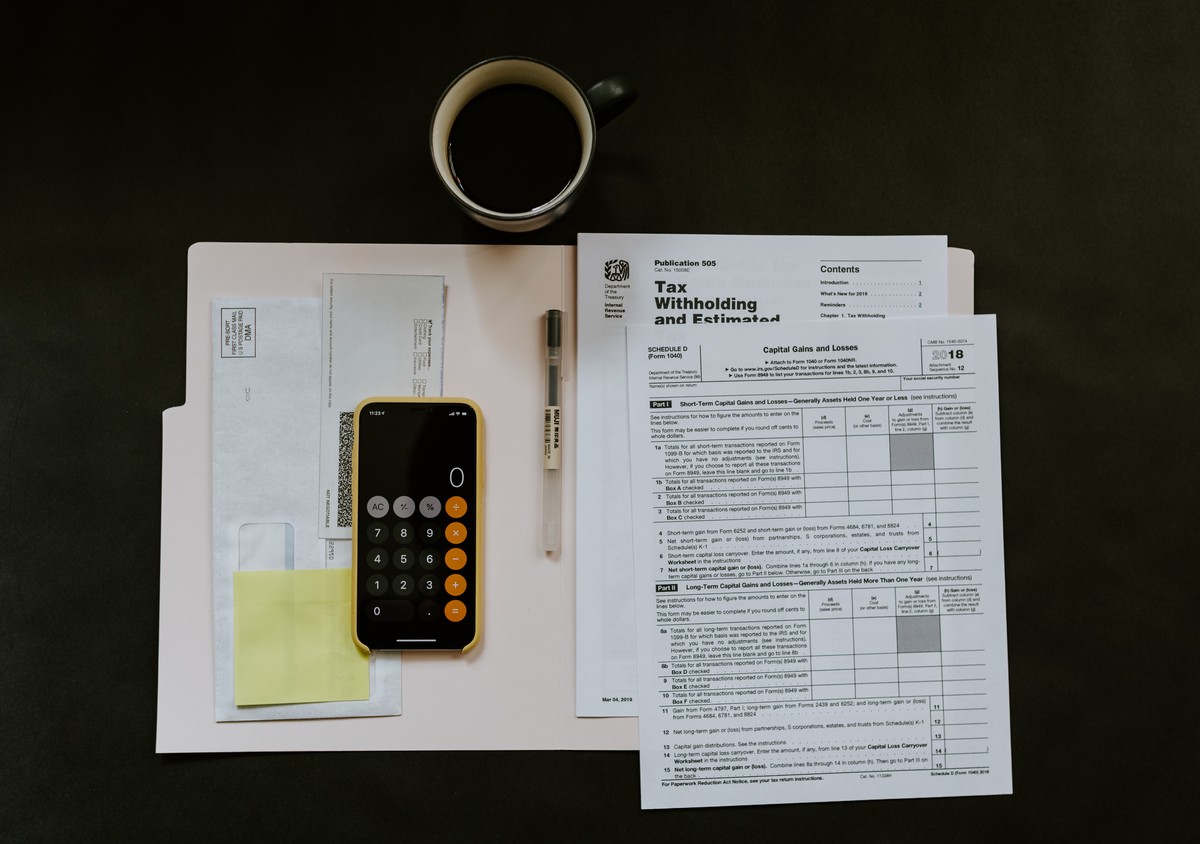

Taxpayer's guide to a stress-free Tax Day return

In the face of the impending Tax Day return deadline, countless taxpayers find themselves in a mad dash to finalize their federal income tax returns. If you're among those scrambling to submit your return today, rest assured, there's still time to meet the deadline, provided your return is in satisfactory condition.

For those seeking a miraculous, last-minute solution to tax preparation, it's essential to recognize that such a magic bullet simply doesn't exist. Nevertheless, if you're not quite ready to file your return, don't panic – an extension can be your saving grace. Several individuals are automatically granted extensions without the need to file for one:

- U.S. citizens and resident aliens living and working outside of the U.S. and Puerto Rico receive an automatic two-month extension for filing their tax returns, though tax payments remain due by April 18.

- Members of the military stationed outside the U.S. and Puerto Rico also benefit from an automatic two-month extension. Those serving in combat zones have up to 180 days following their exit from the combat zone to file returns and pay outstanding taxes. For more information, refer to Pub 3, Armed Forces' Tax Guide.

- Taxpayers in states afflicted by natural disasters may be granted additional time to file, with further details available on the IRS Tax Relief in Disaster Situations page.

Remember, an extension to file does not equate to an extension for paying taxes.

Determining your eligibility

If your gross income surpasses the threshold for your age and filing status, filing a federal income tax return is advisable. Most individuals with an income below $12,950 (or $25,900 for married couples filing jointly) are not obligated to file a federal tax return.

However, filing a return may be beneficial for those seeking specific tax credits, such as the Earned Income Tax Credit.

Paper filing

If you opt for filing a paper return, ensure it is sent via first-class mail before midnight on April 18 to qualify as timely. Although this method meets the deadline, it lacks proof of mailing. It's wiser to use certified or registered mail, which fulfills section 7502 requirements while providing proof of mailing. Keep this in mind when queuing at the post office or navigating the USPS website which you may access via the link here.

Make sure to use the correct address, as this is also crucial for timely filing. Consult the IRS chart to find the appropriate address, and use the Post Office locator to identify a nearby location and its operating hours.

Alternatively, private delivery services approved by the IRS can also satisfy the "timely mailing as timely filing/paying" rule for tax returns and payments. However, brace yourself for a lengthy waiting period, as the IRS estimates processing paper returns may take up to six months.

E-Filing

E-filing by the deadline helps evade the hassle of mailing your return. The IRS encourages e-filing, as it expedites the process – taxpayers can expect their refund within three weeks of the IRS receiving their return. Opting for direct deposit to your checking or savings account can further speed up the process.

Those with an income below $73,000 last year can file for free at IRS.gov.

Advertisement

Also let’s consider whether the taking of an individuals assets without that individual’s consent constitutes theft.

And whether a democratic republic should let democracy determine that fact ..

Are you “sovereign citizen” nut or just hate paying taxes?