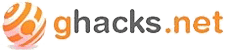

Apple Pay Later is activated server side

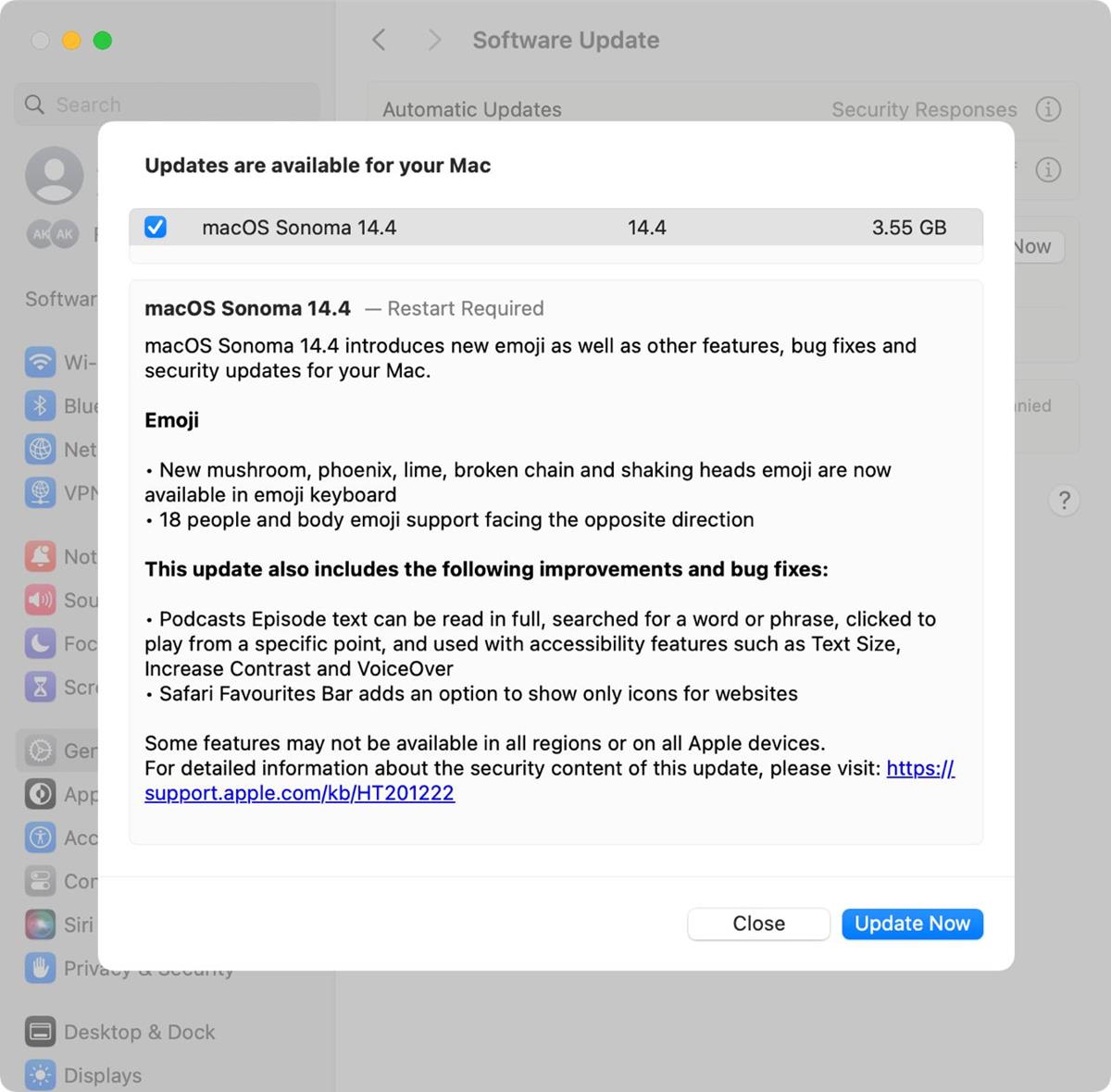

First, there was Apple Pay; then Apple said, “Let there be Apple Pay Later”. For those not following the tech giant’s steps, this might sound like a joke but, incredibly, it isn’t. Apple Pay Later was announced at WWDC in 2022 and is a feature that offers to split your purchases with Apple Pay into four equal, six-week payments.

The major selling point is that these installments won’t have interests or fees to pay. It will come as a built-in feature in the Apple Wallet app. Even before its unveiling in 2022, Apple Pay Later was being tested among Apple’s corporate employees.

Apple Pay Later works in conjunction with the MasterCard network for this and requires no special integration for merchants, so it’s likely its adoption rate will be pretty high. Apple is even setting up a subsidiary, Apple Financing, for this.

Bloomberg’s Mark Gurman has a long-standing track of predicting Apple moves and had mentioned before that this service might be released to the general public with the iOS 16.4 version. However, it was delayed because of technical reasons until 2023.

Now Gurman commented on his Twitter account that Apple Pay Later is activated server side. This is important since it means it’s not tied to iOS 16.4 and could be released independently from a new OS.

A Game Changer?

Making Apple Play Later a separate entity from iOS is a smart move, and allows implementation with fewer restrictions. As for the service itself, there’s a lot of expectation, especially in markets like the US where weekly wages are more common.

Apple Pay Later is also fully compatible with Apple Pay, so you will be able to use it anywhere where Apple Pay is accepted. This effectively lowers a barrier, since nothing is preventing you from using it, should you choose so.

However, it remains to be seen if it’s as useful for people who receive monthly payments given the short interval between payments. If you’re among this group, fret not. Apple has been developing something else for you, too.

Partnered with the Goldman Sachs Group, Apple is also developing Apple Pay Monthly Installments. This will work like a regular credit card, where you can split up transactions over several months with interest. This feature is still unannounced, however.

Be as it may, it clearly shows Apple kicking up gears when it comes to financial services, raising fears in some, given the tentacle-like nature of its business. One such individual is none other than the 21st-century rockstar Elon Musk, who became outraged because Apple was taking a 30% cut of Twitter’s blue subscriptions.

Apple has a history of innovating and being able to successfully reinvent itself, so it’s no wonder the company will keep expanding its offerings not only when it comes to physical devices, but services, too.

Great way to pay for your overpriced Chinese junk.

“.. we were expecting your weekly payment with interest.. we didn’t get that, so your iPhone is now locked, sorry ”

Apple Banking, next I think.

This is very common here in Brazil, but made directly with the credit card emitter.

Yes, except by the fact that almost all merchants here allow up to ten or twelve monthly payments without any interest or price increase.