Visa, MasterCard Plan to link Credit Card Purchases And Online Marketing

If you thought it can not get worse with all the tracking and personalization on the Internet, then you have just been proven wrong.

According to The Wall Street Journal and other sources, both Visa and MasterCard are planning to tie credit card purchases with personalized online advertisement.

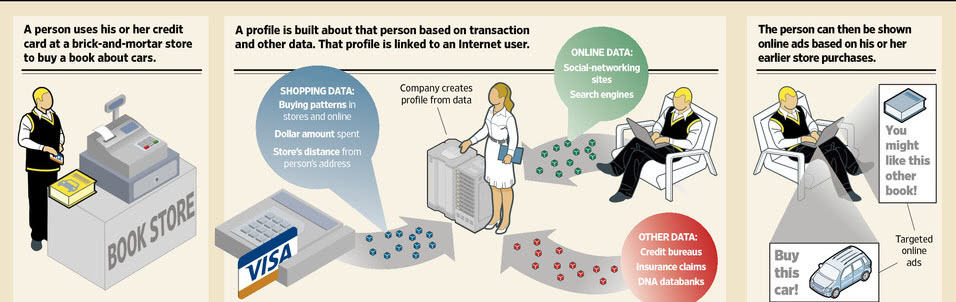

What that means? Glad you asked. You recently bought a new BMW? Expect to see car insurance ads! You are a regular customer at Mc Donalds, Burger King or Kentucky Fried Chicken? Expect weight loss ads to dominate your ad experience on the Internet. Paid your membership to an online dating site with your credit card? See mail order bride ads.

Linking "real-world" purchases to online users is one of the holy grails of Internet marketing. Current advertising companies are already able to link online activity to advertisements. Linking offline purchases on the other hand would push behavioral targeting to another level.

Both credit card companies interestingly enough confirmed that they are exploring ways of using transactional data for targeted online advertisements. A Visa patent application in April for instance revealed plans to use personal details to create online profiles for ad targeting, with personal details taken from a variety of sources including "information from social network websites, information from credit bureaus, information from search engines, information about insurance claims, information from DNA databanks".

A Master Card spokesman stated that the company "doesn't collect card-holders' names or contact information in transactions it processes", and that it therefor "doesn't connect an individual's Web-surfing activity to their specific cardholder transaction data or provide outside companies with individuals' transaction data".

According to the Wall Street Journal article, both companies said that the plans are preliminary. Master Card and Visa are not the only two credit card processing companies that use the billions of credit card transactions for marketing. Most companies disclose in their privacy policies that they may share personal information with third party companies.

Master Card credit card holders can opt-opt of a variety of marketing and tracking related programs. This includes opting-out from the anonymization of personal information to perform data analyzes and from a unique web analytics cookie to avoid the aggregation and analysis of data collected.

The best way to protect yourself? Pay with cash whenever possible. What's your take on this?

Advertisement

certain foods and doing excessive exercise as you can then incorporate this.

With the help of the weight loss pills you can reduce your body weight faster and more easily.

Strive to find if the review, though, is authentic or from real persons.

They aggregated credit card info for a long time. You can not do anything about. Get used to it. But if you block all ads online with adblockplus and get on do not call/mail list, they can not target you.

Scary stuff! I’ll seriously consider cutting up my card if this goes ahead… I mean, I can block the ads with adblock or something but that doesn’t stop them from *aggregating* that info in the first place!

One more reason to look elsewhere. I wasn’t thrilled with them (and Paypal) blocking Wikileaks, not because I necessarily support what it was doing, but I don’t believe apparently legal financial transactions should be held hostage to U.S. domestic politics/jingoism.

Anyone know of a non American card company or Paypal alternative?

Opting out might not be a good thing to do if you have good credit. If opted in, you will be offered things that only good credit people get. Like: 0% on balance transfers and/or purchases for 1+ year. Promotional airline tickets on planes that doesn’t rattle and shake like it’s going to fall apart. Hotel specials because they want people with cash. 0% for five years auto loans. Or special credit cards with privileges (Visa Signature, MC World, AmEx Platinum) and no annual fees.

Can they do this in Europe too?

We have privacy laws here and a lot of stuff that is OK to do in the US it’s illegal here.

Well it really depends what they will do before one can say for sure.

Typos: Vista (in title) and Via (2nd sentence) should be Visa.

This news really irritates me. I guess I feel slightly better knowing that I can opt out of some of this garbage with my MasterCard (thanks for including that link!), but this is something that ought to be nixed via new regulations. It’s just creepy.

Thanks, corrected.

Too late. I mentioned Pakistan/Afghanistan in mail, and was targeted with “mojahedin” ads in Arabic – Google did this.

Adblock is the only action.